1099 hourly rate to salary calculator

Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages is available in the downloadable XLS file. A 1099 contractor making 35hour would then expect to make about 3250hour 3510765.

What S Your Time Worth How To Determine Your Hourly Rate

You will often be asked or offered this number.

. 2017-2020 Lifetime Technology Inc. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in the downloadable XLS file. There are several types of 1099 forms but the most common is 1099-MISC which is used to report miscellaneous income.

Thats why most business owners are comfortable with paying a. CPI Inflation Calculator. From the point of view of business owners they save a lot of money on these benefits and taxes when hiring 1099 contractors for short-term projects.

Major Occupational Groups Note--clicking a link will scroll the page to the occupational group. In the US there are basically two types of employment. Blog Weekly Demo Burn Rate Calculator Glossary of Terms Founder Salary Report Resources Library.

1099 MISC Form. The salary range is based on market rates for that work as well as the experience and skills of the employee. Like salary hourly wages are a base pay rate for an employee.

For tax year 2021 the standard mileage rate for the cost of operating your car van. Sales Tax Calculator Use our free sales tax calculator to find the sales tax rate in your state. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in the downloadable XLS file.

Injury and Illness Calculator. Links to OEWS estimates for other areas and states. Stub creator provides best calculator to calculate in hand salary for hourly and salaried employees on its free salary paycheck calculator tool.

This is simply how much it cost to pay you your annual salary on an hourly basis. File Form 1099-MISC Miscellaneous Income for each person to whom you have paid during the year in the course of your trade or business at least 600 in rents prizes and awards other income payments medical and. Your Daily Fully Loaded Cost rate.

Find your 1099 hourly rate. Links to OEWS estimates for other areas and states. Sign In Talk to an Expert.

Intuits free paycheck calculator makes it a cinch to calculate paychecks for both your hourly and salary employees. Compare your income and tax situation when you work as a W2 employee vs 1099 contractor. We file your business income taxes including 1099 filings and local and federal tax returns so that youre compliant with the IRS.

Form 1099-MISC is used to report other types of income while a Form W-2 is used to report salary or hourly wages. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in the downloadable XLS file. Federal Unemployment Tax Act FUTA FICA.

W-2 hourly rate difference is rarely so simple when an employees annual salary and benefits package are also factors. 21-2021 Directors Religious Activities and Education. When youre a 1099 employee that means you basically work for yourself.

21-2090 Miscellaneous Religious Workers. Free Self Employment Tax Calculator Free 1099 tax calculator. This will tell you what your approximate FLC rate is.

They dont include other. 21-1099 Community and Social Service Specialists All Other. If you are an hourly employee and get paid varying amounts on a weekly every other week or twice a month schedule the calculator works from your after-tax take-home pay by multiplying your monthly take-home by 035 35.

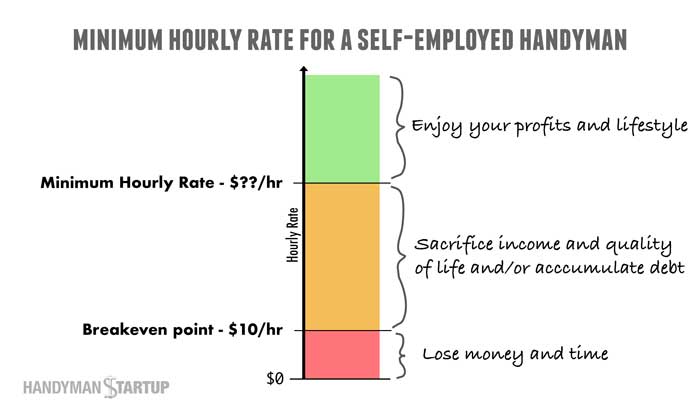

Links to OEWS estimates for other areas and states. Adjusting- 91hr08 114hr on 1099. Thats why we began to develop a consulting hourly rate calculator tool that tells us what rate we must make.

Annual wages have been calculated by multiplying the hourly mean wage by a year-round full-time hours figure. Use this calculator to view the numbers side by side and compare your take home income. Our salary calculator has been updated with the latest tax rates.

This is a great exercise to come up with a target hourly rate that you can use to start negotiations with a client. Enter your employees pay information and well do the rest. We have put together a calculator you can use here to calculate your personal hourly rate.

Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Massachusetts paycheck calculator. Just take your target annual salary and divide it by 1400. W-2 Pay Difference Calculator for Salary and Benefits.

How The Consulting Rate Calculator Works. Our consulting calculator is what we use to negotiate our consultant rates with. If you have a fixed salary the calculation is pre-tax annual salary divided by 40.

Employees can calculate their net pay or take home pay by entering pay period YTD hourly and annual salary rate. Flexible Spending Account FSA Flexible Workplace. That way you can compare the salary for each role to each other role.

And create and send invoices to your customers at an hourly rate. Community and Social Service Specialists All Other. FMLA Family and Medical Leave Act of 1993.

Links to OEWS estimates for other areas and states. 21-2020 Directors Religious Activities and Education. Or if you need to convert a salary into an hourly wage you can divide the salary by 2080.

Fee-free W-2 and 1099 processing. Form 1099-MISC reports a. Links to OEWS estimates for other areas and states.

CD Calculator Compound Interest Calculator Savings Calculator. Many jobs have a salary rangea minimum and maximum amount that a company is willing to pay to fill a position. A new hire with little experience might be paid the minimum amount in that salary range as their basic salary.

Of course knowing the 1099 vs. 13-0000 Business and Financial Operations. Manage 1099 Invoicing 2 Manage 1099 payments 2 Manage Direct Deposits 1 Mapertunity 1.

Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in the downloadable XLS file. You can generally lower your rate for longer term contracts as your utilization rate will increase. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in the downloadable XLS file.

What S Your Time Worth How To Determine Your Hourly Rate

Toast Payroll How To Change An Employee From Salary To Hourly

Printable 25 Printable Irs Mileage Tracking Templates Gofar Vehicle Mileage Log Template Sam Report Template Professional Templates Business Template

How To Invoice For Hourly Work

Toast Payroll How To Change An Employee From Salary To Hourly

.png?width=669&name=Turn%20Something%20like%20this%20into%20something%20like%20this%20053117(7).png)

One Secret Your Hr Department Does Not Want You To Know Calculator

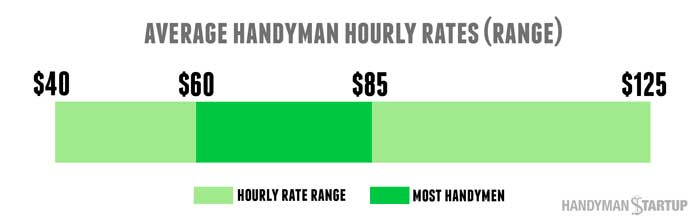

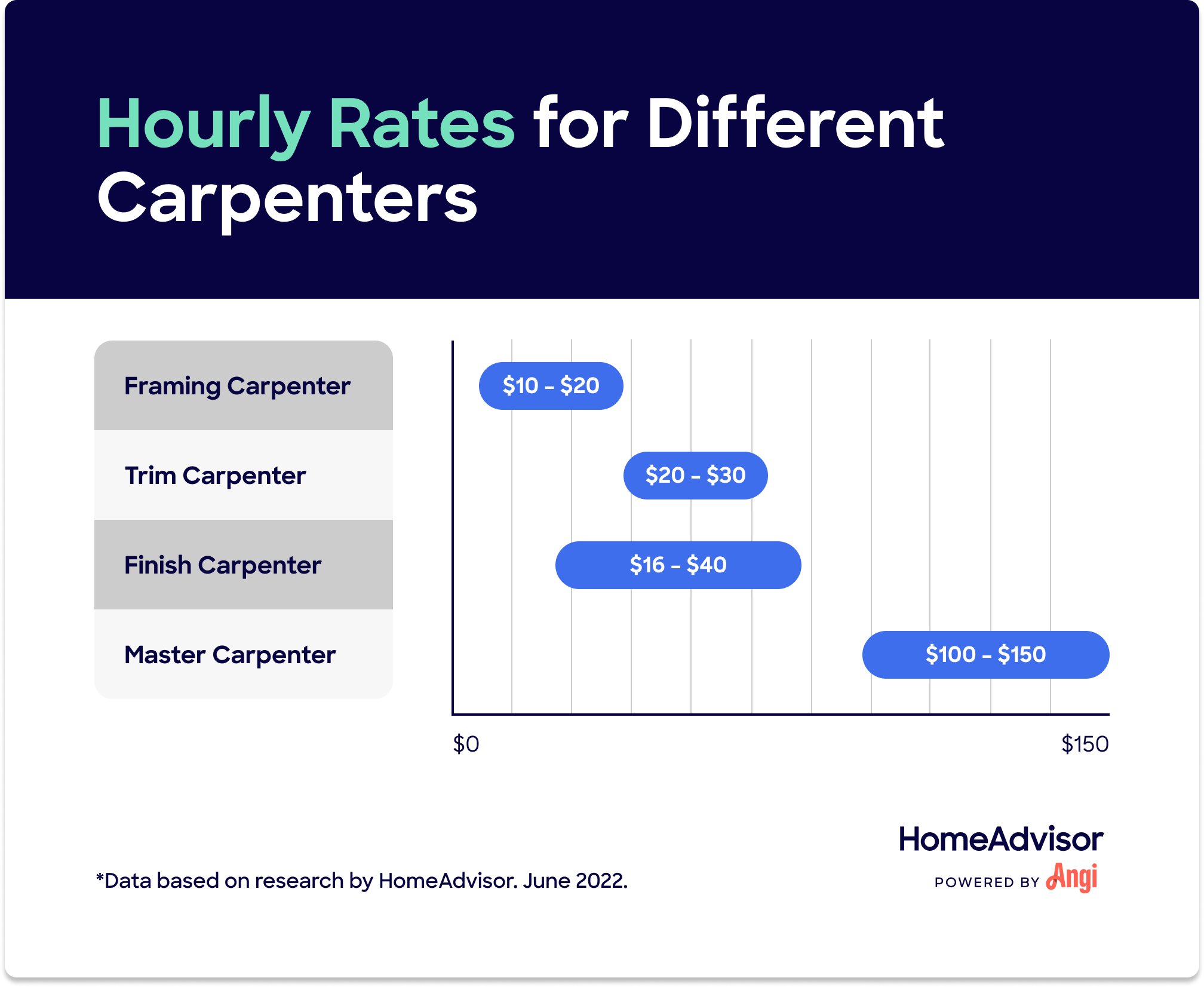

What Are Average Carpenter Hourly Rates

2019 Salary Budgets Inch Upward Ever So Slightly Budget Forecasting Budgeting Salary

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

What S An Hourly Rate For Freelance Graphic Designer Quora

Salary To Hourly Salary Converter Salary Hour Calculators

Solved W2 Box 1 Not Calculating Correctly

How To Calculate My Current Salary Into A Contractor Hourly Rate In Canada Quora

Hourly Wage Then Log Download Pay Stub Template Word Free With Regard To Pay Stub Template Word Document Cumed O Word Free Templates Microsoft Word Templates

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Toast Payroll How To Change An Employee From Salary To Hourly

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax